Outside the US

If you’re using Products, we’ll assign the tax rate for each product automatically, and calculate the total for each invoice.

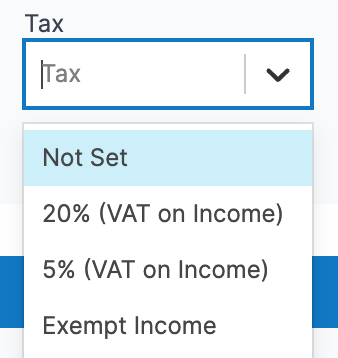

If not, you’ll see a tax field at the top of the screen. Each revenue account can have a default tax rate in your accounting platform, so often if you select Account first, the tax rate will be selected. If you need to set taxes line by line, you can click “Customise Accounts and Taxes” to select each line. If you’d like to set a default tax rate for all invoices - get in touch with us.

If you’re using Xero, each customer can have a default tax rate too, so if this is set in Xero, then selecting the customer will override the tax selection. This is really helpful if you have customers outside your country who you don’t need to charge tax to.

Inside the US

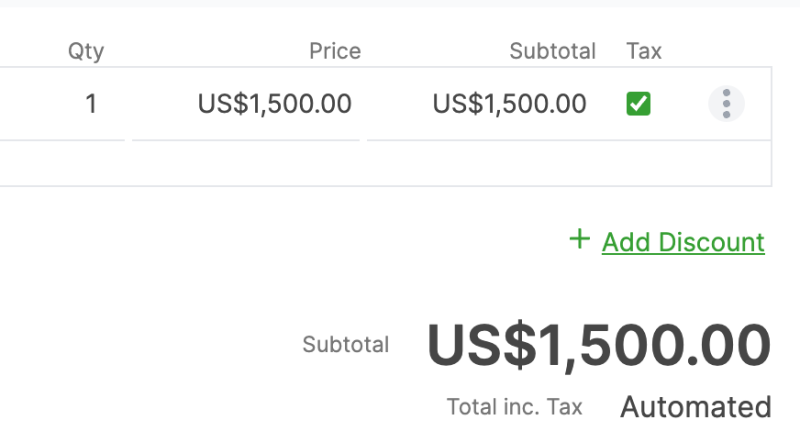

If you’re using Products, we’ll assign the tax status for each product automatically.

If you’re using QuickBooks Online, and the tax is set to “Automated” - then your taxes will be calculated automatically based on location, once the invoice gets synced with QuickBooks. You can alternatively set a custom tax rate override.

If you’re using Xero and using the Alavara tax calculation plugin - then you can select the “Auto LookUp” tax rate. However - taxes will not be calculated until you’ve entered the source and destination manually inside Xero.